CBN June 3 Deadline Stands Firm as ABCON Urges Dialogue Over BDC Recapitalization

The Central Bank’s June 3 recapitalization deadline for BDCs has passed, leaving the sector in suspense as compliance levels remain unclear.

ABCON maintains its support for the policy, despite lingering fears of job losses and widespread shutdowns among unprepared operators.

With the Central Bank of Nigeria (CBN) holding firm on its June 3, 2025, deadline for Bureau De Change (BDC) operators to meet new recapitalization thresholds, the Association of Bureau De Change Operators of Nigeria (ABCON) has reaffirmed its commitment to the process even as concerns grow over the sector’s readiness.

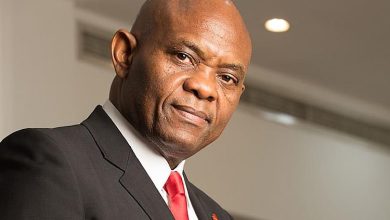

Speaking after a crucial stakeholders’ engagement in Lagos, ABCON President Aminu Gwadebe confirmed that the apex bank’s recapitalization directive remains unchanged. He emphasized that the CBN still maintains the new minimum capital requirement of ₦2 billion for Tier 1 BDC licenses and ₦500 million for Tier 2, a significant jump from the previous ₦35 million benchmark for general licenses.

“The deadline for the existing BDCs for recapitalization by June 3rd, 2025, remains sacrosanct,” Gwadebe said. “Also, the minimum capital requirements of ₦2 billion for Tier 1 and ₦500 million for Tier 2 remain unchanged. We appreciate the CBN’s willingness to consult with stakeholders and acknowledge our critical role in retail forex operations.”

This latest development comes after initial calls from ABCON urging the CBN to consider extending the deadline further, citing potential widespread job losses and economic disruptions if a substantial portion of BDCs fail to meet the requirement. Despite these appeals, the CBN has made it clear that the deadline and licensing standards will not be revisited.

A sector on edge

The recapitalization policy, introduced in 2024, sent shockwaves through the BDC industry. According to ABCON, less than 5% of its members have been able to meet the revised capital requirements, an alarming statistic that raises serious questions about the future of thousands of small-scale operators.

“The entire sector is heightened with anxiety,” Gwadebe said in a previous interview. “As the deadline draws nearer, most of our members are uncertain. Still, we hold onto hope that we will remain viable players in the market.”

Indeed, there are growing fears that many operators will be forced out of business if a middle ground is not found. While ABCON continues to engage in high-level talks with the CBN to reach a “win-win” outcome, the deadline looms with no signs of policy revision.

What the CBN aims to achieve

The recapitalization drive is part of the CBN’s broader effort to sanitize the foreign exchange market and better integrate BDCs into its policy transmission mechanism. By increasing the capital threshold, the apex bank seeks to ensure that only financially stable and compliant operators remain in the market.

The CBN has also expressed concerns over past abuses in the BDC sector, including issues around documentation, forex hoarding, and unauthorized speculative trading. Officials believe that a leaner, better-capitalized group of BDCs will strengthen Nigeria’s fight against currency volatility and black-market manipulation.

Openings for new investors

Despite the stringent deadline for existing BDCs, ABCON confirmed that the window for new licensing remains open, with the CBN pledging to accelerate the approval process for serious investors.

“This shows there is still room for new entrants who can meet the requirements, and we encourage interested investors to take advantage of this,” Gwadebe said.

He also reassured stakeholders that the association is committed to working with the CBN on policy reform while also lobbying for more practical capital thresholds that align with international standards.

A sector at a crossroads

As the June 3 deadline arrives, the fate of Nigeria’s BDC sector hangs in the balance. With thousands of operators potentially facing closure, the outcome of this recapitalization policy will likely redefine the structure and stability of Nigeria’s forex market for years to come.

While some see this as a much-needed clean-up, others fear it may widen the gap between official and parallel market rates, especially if retail access to forex becomes constrained.

What’s certain is that the CBN, with ABCON’s cooperation, is determined to shape a more transparent and regulated BDC landscape, regardless of the growing anxiety within the sector.