CBN Governor Says Inflation Easing, Naira Confidence Growing as MPC Retains Key Rates

CBN Governor Olayemi Cardoso says inflation is easing and confidence in the Naira rising.

He highlights investor interest and reforms as signs of progress toward economic stability in Nigeria.

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has expressed renewed optimism about the country’s economic trajectory, stating that inflation is gradually being brought under control and that public confidence in the Naira is steadily improving.

Speaking after the conclusion of the latest Monetary Policy Committee (MPC) meeting on Tuesday, Cardoso revealed that investor interest in Nigeria’s financial sector, particularly the banking industry, has seen notable growth. He attributed this to the bank’s ongoing regulatory efforts and measures aimed at fostering stability and reinforcing trust within the system.

“We are seeing increasing confidence in the Naira and a more disciplined macroeconomic environment,” Cardoso said. “Our monetary tools are having an impact, and we’re committed to maintaining policy consistency to consolidate these gains.”

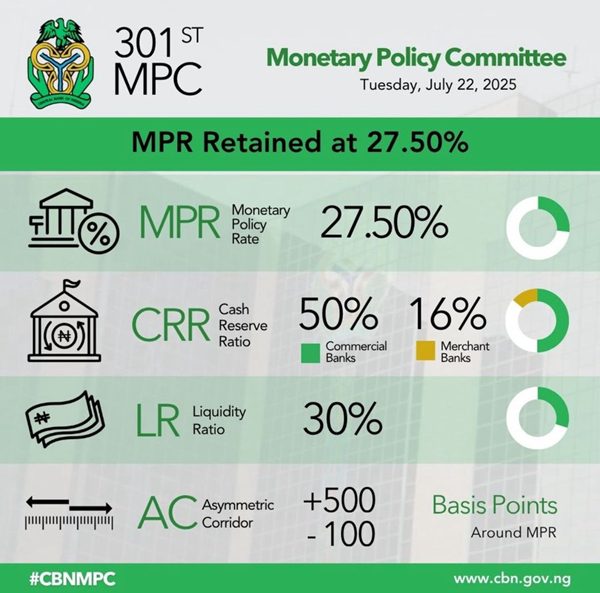

During the meeting, the MPC unanimously agreed to retain the Monetary Policy Rate (MPR) at 27.5%. Other key parameters were also left unchanged: the Cash Reserve Ratio (CRR) remains at 50% for Deposit Money Banks and 16% for Merchant Banks; the Liquidity Ratio was held at 30%; and the Asymmetric Corridor remains at +500/-100 basis points around the MPR.

According to Cardoso, these decisions reflect the committee’s cautious approach to balancing inflation control with economic growth and financial sector stability.

He further emphasized the CBN broader institutional reforms, noting a strategic shift in how the apex bank operates.

“We are strengthening thought leadership at the CBN by engaging diverse perspectives, enhancing learning channels, and encouraging open dialogue,” Cardoso said. “The CBN is evolving from the traditional central bank model to a more inclusive, dynamic, and transparent institution.”

Cardoso’s comments come as Nigeria battles inflationary pressures driven mainly by currency volatility, energy prices, and global economic shocks. However, with recent policy tightening and exchange rate reforms, analysts suggest inflation may begin to moderate in the coming quarters.