Cooking Gas Price Hits N2,000 Per Kg as FG Promises Relief Next Week

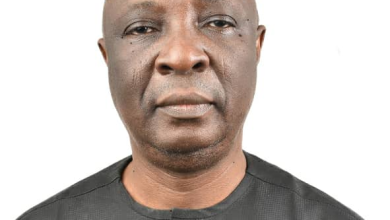

Minister of State for Petroleum Resources (Gas), Ekperikpe Ekpo, has ordered action against marketers hoarding cooking gas.

He said the government is working to stabilize prices after weeks of sharp nationwide increases.

The Minister of State for Petroleum Resources (Gas), Ekperikpe Ekpo, has ordered regulatory agencies to take firm action against marketers hoarding or exploiting consumers following a sharp rise in the price of Liquefied Petroleum Gas (LPG), commonly called cooking gas.

The directive, contained in a statement by the minister’s spokesperson, Louis Ibah, on Monday, came amid growing public complaints over sudden price hikes across major Nigerian cities.

In recent weeks, the price of cooking gas has surged from about N1,000 per kilogram to between N1,600 and N2,000 in some areas. In parts of Lagos, residents now pay up to N2,080 per kilogram, with a 12.5kg cylinder selling for between N21,600 and N26,000. In Abuja, the same quantity averages around N20,000.

Ekpo linked the price spike to two key factors the temporary halt in LPG loading at the Dangote Refinery due to a strike by the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN), and maintenance work at Nigeria LNG’s Train 4, which has limited domestic supply.

He said the government is in talks with operators to stabilize the market, assuring citizens that the disruption is temporary and supply levels should normalize soon.

However, despite the end of the PENGASSAN strike nearly two weeks ago, prices remain high, with some stations reportedly hoarding products to maximize profit amid scarcity.

Ironically, data from the National Bureau of Statistics (NBS) show that just a month earlier, LPG prices were on the decline. The average retail cost of refilling a 5kg cylinder dropped by 22.32 per cent from N8,243.79 in July 2025 to N6,404.02 in August. Similarly, the 12.5kg cylinder price fell by 21.42 per cent within the same period.

Energy economist Bala Zakka described the situation as evidence of “deep structural weaknesses in Nigeria’s domestic gas market,” warning that without stable supply systems, consumers would continue to face sudden price shocks.